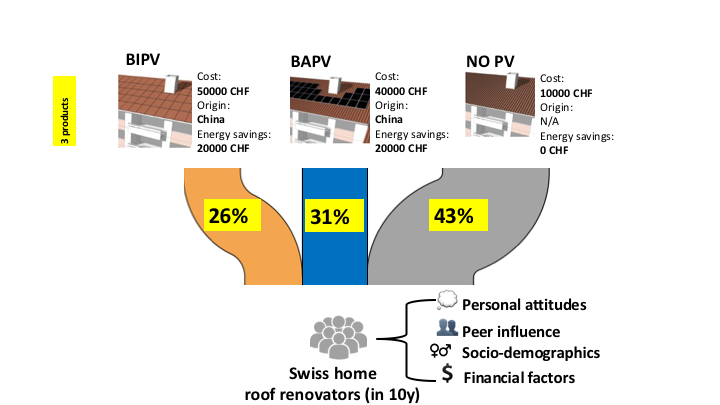

The ACTIVE INTERFACES project investigated these questions through a large representative survey among Swiss homeowners who planned to renovate their roof within the next 10 years [1]. A roof renovation often prompts households to consider adopting a solar system [2], and this is the most likely scenario for a private homeowner to consider purchasing a building integrated (BI)PV solution. Roof renovators compare a BIPV solution to a more traditional building attached (BA)PV solution, and to the status-quo option: a standard roof without any solar PV system.

The survey was designed to investigate the extent to which financial and non-financial factors drive homeowners’ preferences for PV in Switzerland. In order to estimate which percentage of future Swiss roof renovators could opt for a BIPV solution, we used a choice experiment: survey respondents had to choose repeatedly between different roof renovation solutions, varying according to the features that can create customer value [3-5]: technology (BAPV, BIPV, no PV), color, total upfront investment cost, origin of the PV modules, expected energy savings over the next 20 years, and a purchasing incentive.

The resulting customer segmentation (Fig. 1) revealed that 43% of Swiss renovators would not install PV at all on their roof, while the other 57% were almost evenly split between those willing to pay a premium for solar modules with beauty and visual appeal (BIPV potential customers) and those who, at the end of the day, care more about the budget and prefer a standard, even if potentially less visually appealing, solution (BAPV potential customers).

Results show that, on average, private home owners are willing to pay a premium of 22% for a roof with BIPV installation, compared to a roof with a rack-mounted PV installation. BIPV creates additional value thanks to its visual appeal, and this is especially true for people who care about aesthetic features in their general purchasing decisions.

The color and country of origin of solar panels also have an impact on willingness to pay and likelihood of adoption. Black and, especially, red PV panels are a better match for customers’ preferences than blue, which is still the standard color used for most PV installations. Swiss homeowners prefer European PV panels to Chinese PV panels, and Swiss-made panels to German ones. Disclosing the country of origin of a module “made in Switzerland” can have a positive impact on BIPV diffusion. Swiss manufacturers could emphasize the origin of the panels in their marketing efforts to differentiate themselves on the basis of the country-of-origin effect.

The study suggests that solar system suppliers should have both solutions in their portfolio: not just an economy model produced by manufacturers who focus on cost leadership, but also a premium, higher-priced BIPV solution for those customers who are willing to pay for design.

Potential BIPV customers are not necessarily wealthier or those who have a higher education. What distinguishes potential BIPV customers from BAPV ones is that they care more about aesthetic aspects in general purchasing decisions and show higher concern for the environment.

Demand for colored BIPV modules is therefore likely to come from product design lovers and from highly environmentally aware customers. Suppliers could target them by placing advertisements for BIPV in design magazines, by promoting colored BIPV in design hotels or galleries, by participating in design exhibitions and furniture fairs, by cross-selling with other green products, or by collaborating with architects when equipping high-profile public buildings with colored BIPV.