Many electricity suppliers today are looking for new business models to integrate renewable energy into their product portfolio to satisfy an increasing demand and enhance customer loyalty. One increasingly popular innovative business model is community solar – the idea of allowing retail customers to invest in solar installations that are not situated on their own roof. Community solar offerings have been introduced by a variety of players, including electric utilities, local initiatives, and cooperatives.

This is especially attractive for customers in urban areas, where many people live in rented apartments and hence do not have the possibility of installing solar panels on their own [1]. Community solar allows electricity consumers to initially buy shares of a solar plant in the vicinity. In return, they get compensated either financially or through physical delivery of the solar power from the plant. Fig. 1 illustrates a community solar offer with BIPV modules. Community solar is still at the early stages of diffusion, but enjoys increasing popularity in the US and Europe [2,3,4].

The increasing popularity of community solar can contribute to increasing the share of power generated in cities. In addition, the continuous development of photovoltaics (e.g. building-integrated PV) is creating an increasingly broader application context. Community Solar offers numerous advantages for suppliers and customers [1,3,5], and additionally creates, through the direct involvement of customers as investors, an increased awareness of regional and sustainable power generation as well as of power consumption and energy system transformation in general [3,4].

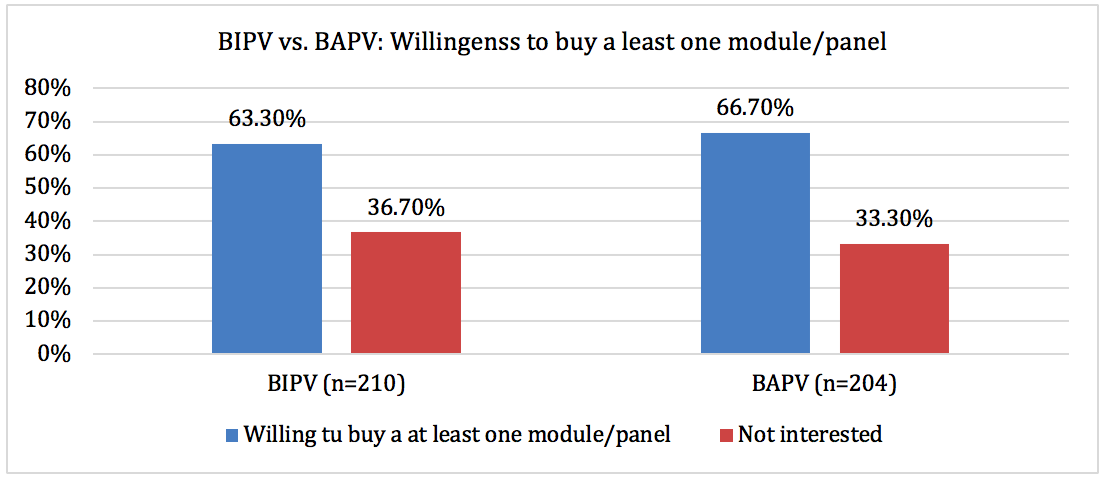

Based on that, a representative survey by the University of St. Gallen assessed whether community solar offerings with BIPV could cause the same willingness to invest as when it was offered with building-attached (BAPV) panels only. Consequently, the offers differed in only one aspect, BIPV versus BAPV, while all other factors such as price, contract duration, deliverables, etc. were held constant.

The BIPV offer was evaluated by 210 participants, and the BAPV offer by 204 participants (total sample=414). Results indicate that about 63% of study participants would be willing to invest in BIPV modules as part of a local community solar project, while for the same community solar project offering BAPV instead of BIPV, we found 67% willing to buy at least one panel (Fig. 2). On average, participants would invest in 2.6 BIPV modules (=1’300 CHF) or 2.8 BAPV panels (=1’400 CHF), which was not significantly different (ANOVA of means p=0.267).