What is the profitability of a BIPV installation?

Because economic performance is a predominant factor in the intention to install BIPV, financial analysis of a retrofit project incorporating BIPV can help overcome certain preconceived ideas that represent barriers to the deployment of large-scale solar energy.

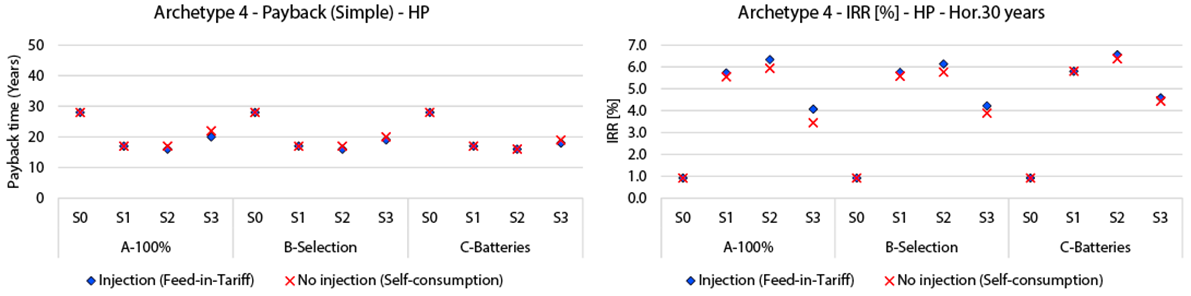

Fig. 1 and 2 present the results of the life-cycle cost (LCC) analysis regarding the whole renovation project, including BIPV strategies and the replacement of the existing oil-boiler by an electric heat pump. In addition, we propose three comparative energy-use scenarios related to the sizing of the BIPV installation and the implementation of storage systems.

- A-100% takes into account the activation of 100% of the possible surfaces detected during the implementation of each renovation scenario [cf sheet 2.3].

- B-Selection takes into account only those active surfaces that allow an equilibrium between self-consumption and self-sufficiency, resulting in an installation that is better adapted to the demand of the building. The rest of the possible active surfaces will present the same visually but without PV cells.

- C-Batteries takes into account the selection from scenario B, to which a battery system is added, in order to increase self-consumption and self-sufficiency potential.

Simple payback time (SPBT): number of years necessary to recover the investment cost taking into account as income the annual energy saving cost. Internal rate of return (IRR): interest rate (or discounted rate) that gives a net present value (NPV) of zero. Equivalent to the minimum interest rate that is needed to receive in an alternative investment to equalize the investment in the renovation.

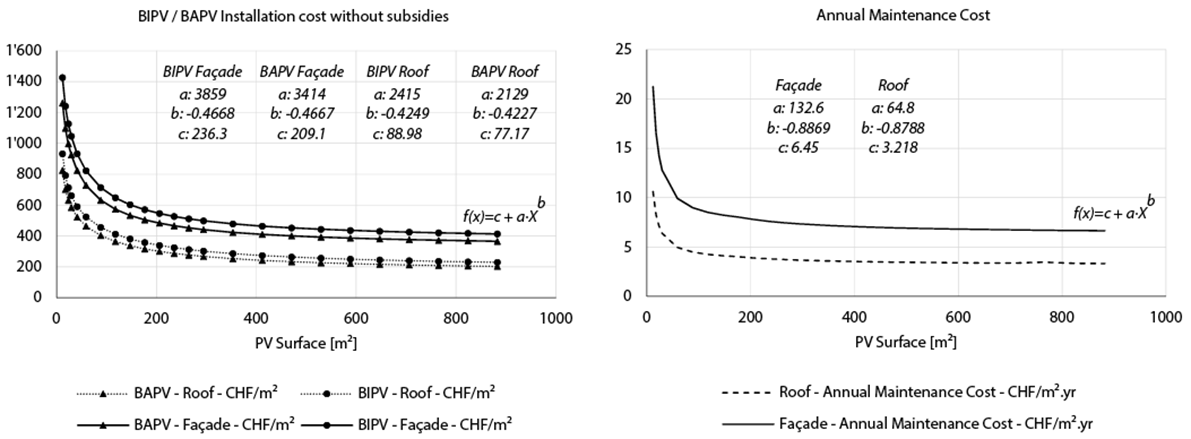

The cost of the BIPV installation is based on the market study conducted by OFEN in 2016 [2] and the web tool [3]. This data was treated in order to obtain a series of curves (Fig. 3) allowing to use the cost value parametrically in function of the active surface selected. The cost includes all installation components (PV panels, junction box, connections, cabling and inverters).